Table of Contents

1. Fact Pattern

- A Chinese National emigrates to the U.S. and becomes a U.S. citizen or resident.

- U.S. Citizen has a trust holding his/her U.S. assets.

- U.S. Citizen also has assets in China:

- Real Estate

- Stock

- Cash in Bank Accounts

- Movable Property (i.e. vehicles)

Chinese law requires the Chinese national to relinquish Chinese citizenship when taking on U.S. citizenship.

2. Overview of Inheritance System in China

An Estate Plan Starts with the End in Mind.

How Are Assets Distributed Upon Death?

2.1 Intestate Succession

- All assets obtained during marriage are part of the marital estate, even if title is only in one spouse’s name.

- Half of all marital assets belong to the deceased’s spouse. The other half can be distributed among other successors.

- If the deceased dies intestate (without a will), the estate is distributed equally by all parties in the same rank:

First Rank Spouse, Children, Parents Second Rank Brothers and Sisters, Paternal & Maternal Grandparents - The heirs in the Second Rank only inherit if there are no heirs in the First Rank.

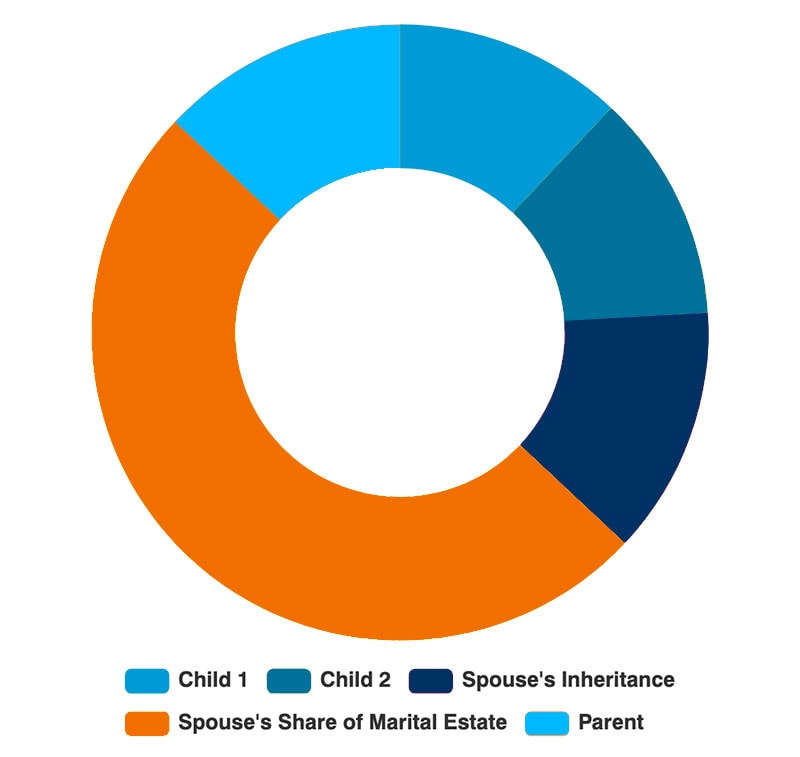

Intestate Asset Distribution Examples: Rank 1 Scenario

Rank 1 Scenario (% of Total Assets Allocated per Successor)

- Surviving spouse is entitled to 50% of the value of the Marital Estate.

- The deceased’s portion of the Estate (the remaining 50%) is shared equally among the spouse, surviving parent of the deceased, and children 12.5% each.

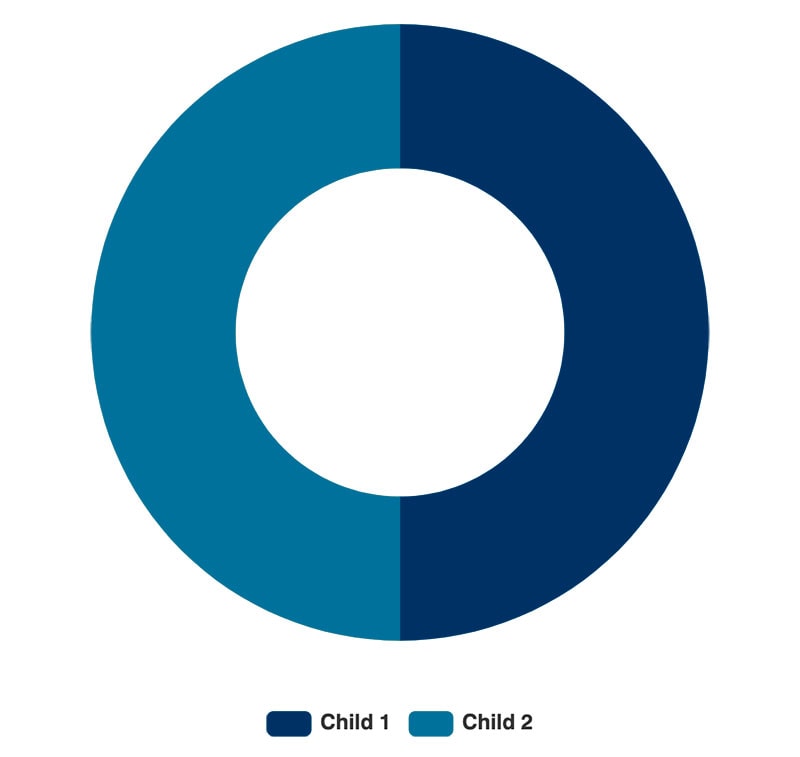

Rank 1 Scenario (% of Total Assets Allocated per Successor)

- No Surviving Spouse.

- 2 Surviving Children Share the Estate Equally.

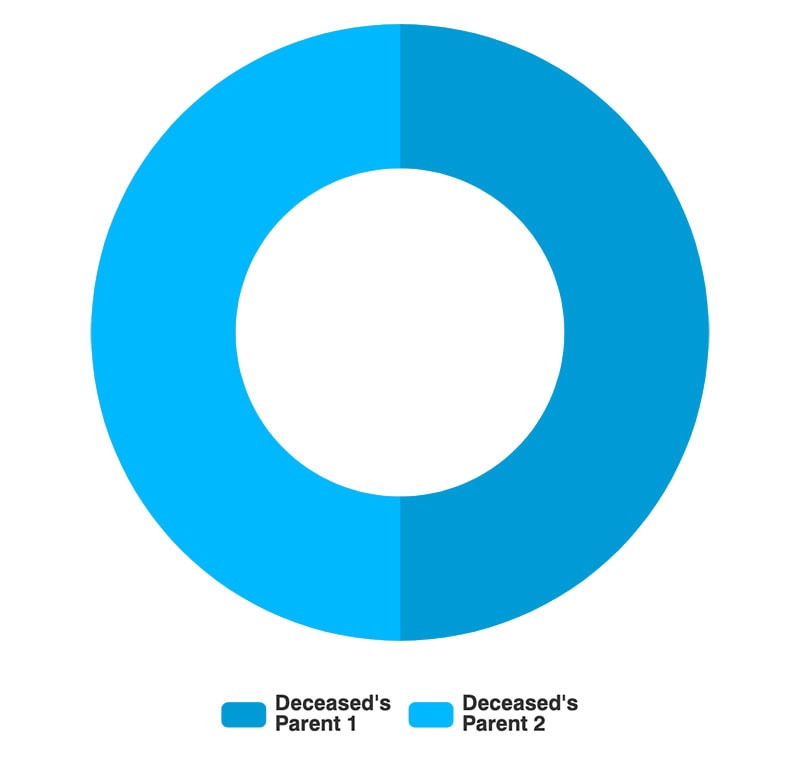

Rank 1 Scenario (% of Total Assets Allocated per Successor)

- No surviving children or spouse so parents become successors and inherit equal portions of the estate.

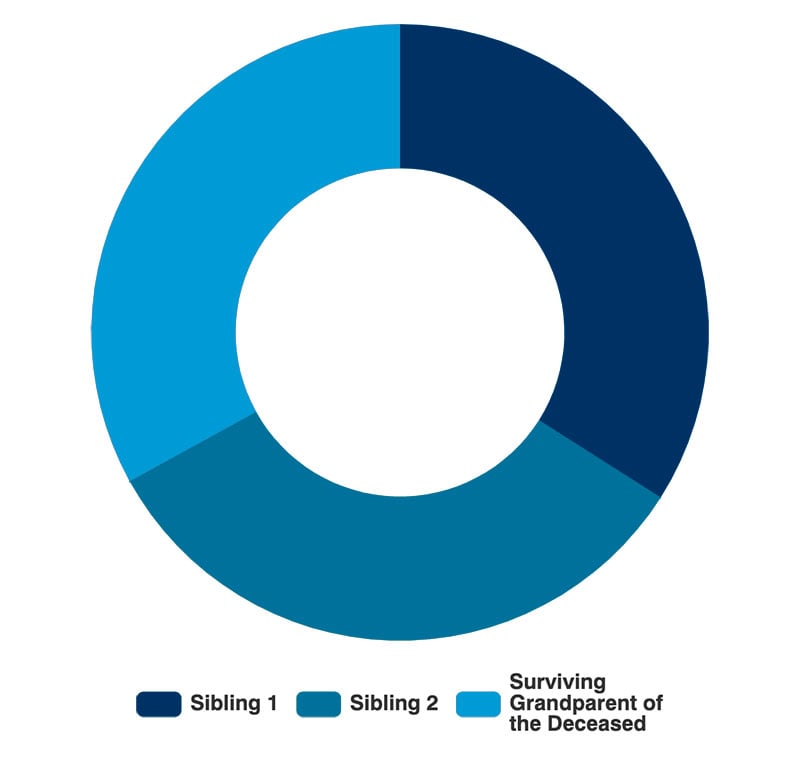

Intestate Asset Distribution Examples: Rank 2 Scenario

Rank 2 Scenario (% of Total Assets Allocated per Successor)

- No Surviving Spouse, Children or Parents.

- The surviving grandparent and siblings inherit equal portions of the estate.

2.2 Wills

- The courts will generally distribute assets as set out in a valid will.

- A will can be challenged on grounds of validity and fairness to the heirs.

- A will prepared overseas can be used in China if it is notarized and then legalized by the Chinese Consulate or Embassy.

2.3 Inheritance Certificate

- Notarized by a People Republic of China (PRC) notary where the assets are located.

- Lists the details of inheritance.

- Required by various organizations, agencies or offices to effect transfer of assets to successors.

- Needed regardless the existence of a valid will.

- Notarization Fee depends on location and is typically a percentage of the aggregate value of the estate. (For example 1% in Shanghai)

2.4 Required Documents

Documents Needed to Obtain Inheritance Certificate.

- Power of Attorney*

- Authorizing a person in China to act on behalf of the heirs in the process of notarization & registration of change of ownership of the assets.

- Passports and Identification Documents of Successors

- Birth Certificate or Other Documents Showing Relation to Deceased*

- Death Certificate*

- Will * (if any)

- Affidavit of Intestacy * (If no will exists)

- A document stating that there is no will in existence or any gifts to non-statutory heirs by the deceased

- Succession Agreement* (if any)

- If any heirs waive their proportion of the inheritance assets

- Documents Specific to Assets Being Inherited

- (Original Real Estate Certificate, Original Purchase Contract for Real Property, Bank Statement Listing the Deposits in the Deceased’s Account(s), Articles of Association of the Company Whose Shares Are to be Inherited, Road Worthiness Certificate for Automobiles to be Inherited, Automobile Registration Certificate)

*If the document is issued outside of China, it must be notarized by a local notary and legalized by the Chinese Embassy or Consulate with jurisdiction over that location.

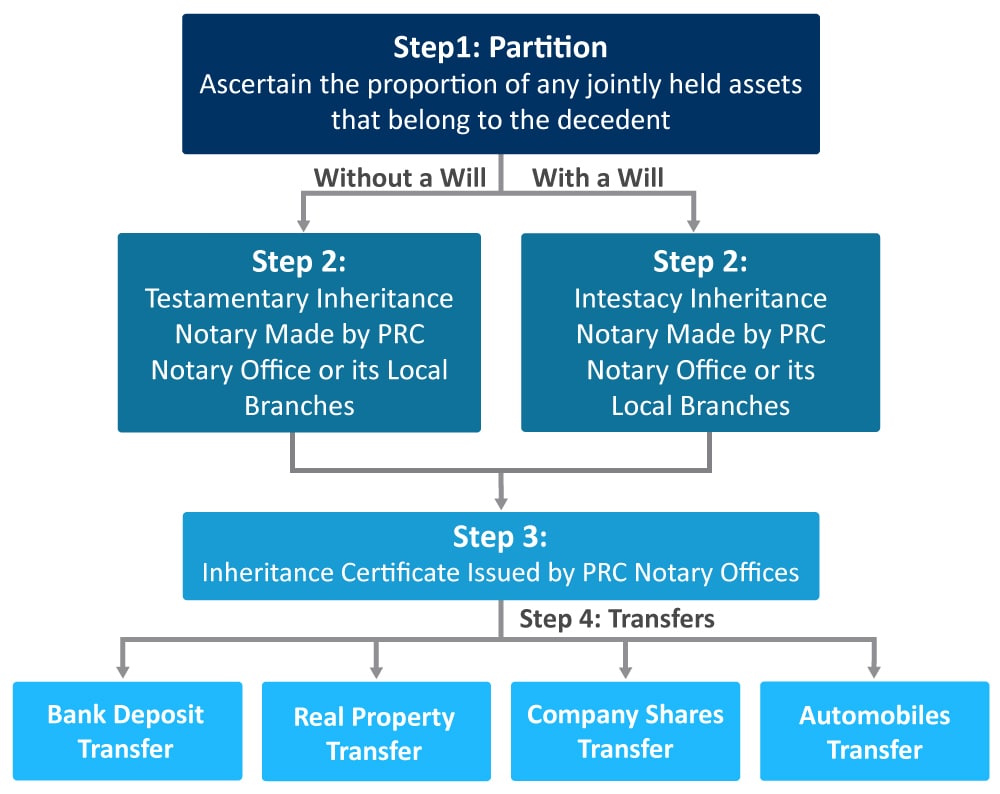

2.5 Process

3. Use of Trusts in China

- While Chinese law recognizes Trusts, they are cumbersome, costly and do not allow a Beneficiary to be a Trustee. Therefore, the use of trusts in China as an estate planning tool is very rare.

- Title to Real Estate, Stock and Other Assets are typically held in the name of an individual or company.

4. Inheritance/Gift Taxes in China

- Inheritance Tax: 0%

- Gift Tax: 0%

Even though there is no inheritance or estate tax in China, notary fees to obtain the inheritance certificate can be significant depending on the location of the assets. (i.e. 1% of the estate value in Shanghai)

5. Common Estate Planning Issues in China

- Use of a U.S. (Overseas) Will

- Assets in China Cannot be Held by a U.S. (Overseas) Trust

- Proving Identity of Heirs/Successors

- Gathering Documentation

- Obtaining Notarizations and Legalizations (Dealing with Consular Bureaucracy)

Pamir’s Estate Planning Services