Table of Contents

- Fact Pattern

- General Rules of Succession

- Intestate Succession

- Intestate Asset Distribution Examples

- Taiwan Will Formalities

- 5.1 Types of Wills

- 5.2 Witnesses

- 5.3 Limitations to Asset Distribution

- Overview of Inheritance System in Taiwan

- 6.1 Process

- 6.2 Required Documents

- 6.3 Use of Trusts in Taiwan

- Inheritance Taxes in Taiwan

- Common Estate Planning Issues for Taiwan

1. Fact Pattern

- A Taiwanese National emigrates to the U.S. and becomes a U.S. citizen or resident.

- U.S. Citizen has a trust holding his/her U.S. assets.

- U.S. Citizen also has assets in Taiwan, registered to his/her name:

- Real Estate

- Stock

- Cash in Bank Accounts

- Movable Property (such as a car)

- U.S. Citizen passes away and successors/heirs (spouse, children or other) need to identify/divide assets, and pay all required inheritance taxes.

2. General Rules of Succession

An Estate Plan Starts with the End in Mind.

How Are Assets Distributed Upon Death?

- No “probate” process in Taiwan. Each government office or agency in charge of transferring assets (real estate, banks, etc.) will ask for specific documents to prove the right to inheritance.

- The total of all assets obtained during marriage—without regard to whose name is registered as owner of an asset—is added together to determine the value of the Marital Estate. (Unearned assets such as those obtained by inheritance or gift are excluded.)

- A surviving spouse is entitled to 50% of the value of the Marital Estate, and the remaining 50% of the Marital Estate is then distributed according to the ranking below.

Example: If the total Marital Estate is worth $100, and $40 worth of assets are registered in the name of the surviving spouse, then the surviving spouse is allocated another 10, and the remaining 50 is distributed according to the ranking below.

3. Intestate Succession

- If the deceased dies intestate (without a will), the deceased’s portion of the Marital Estate (50%) will be distributed according to the following rank:

First Rank Spouse, Children (even from different spouses or out of wedlock) in equal proportion. Second Rank Spouse (1/2), Parents of Deceased share the remaining half equally. Third Rank Spouse (1/2), Decease’s Siblings share the remaining half equally. Fourth Rank Spouse (2/3), Grandparents of Deceased share the remaining one-third equally. - Except for the spouse, if there are no others in the First Rank, then the successors in the Second Rank will inherit, and vice versa. Once there is succession in one ranking, then the succession stops (for example, if the deceased has children, then the deceased parents are not entitled to asset distribution).

- If the deceased dies with a will, an heir who was disinherited may still have a monetary claim against other heirs for what he/she would have received according to the rankings listed above.

4. Intestate Asset Distribution Examples

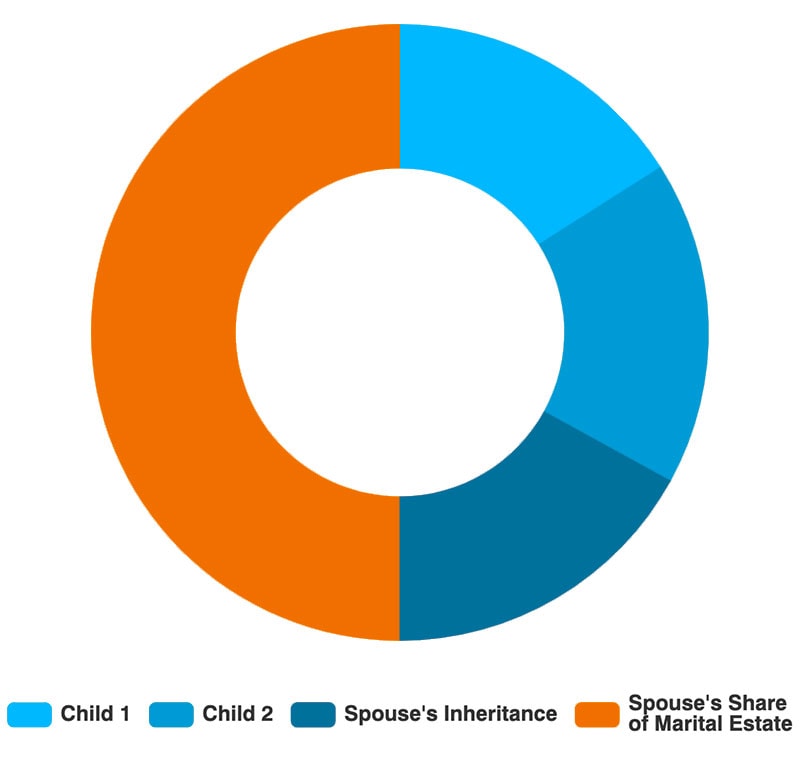

Rank 1 Scenario

Rank 1 Scenario (% of Total Assets Allocated per Successor)

- Surviving spouse is entitled to 50% of the value of the Marital Estate.

- The deceased’s portion of the Estate (the remaining 50%) is shared equally between the spouse and children (~17% each).

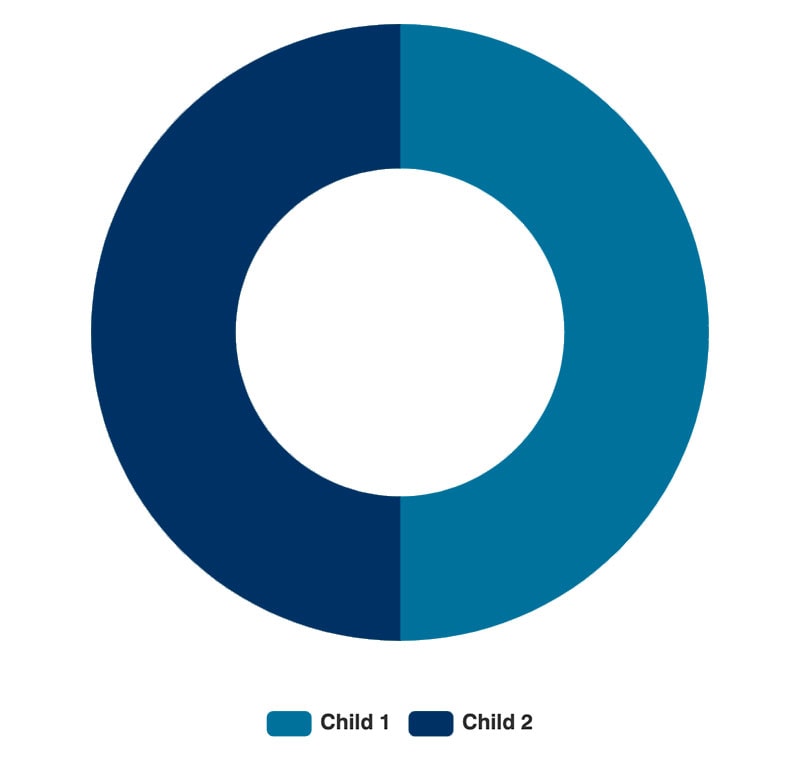

Rank 1 Scenario (% of Total Assets Allocated per Successor)

- No Surviving Spouse.

- 2 Surviving Children Share the Estate Equally.

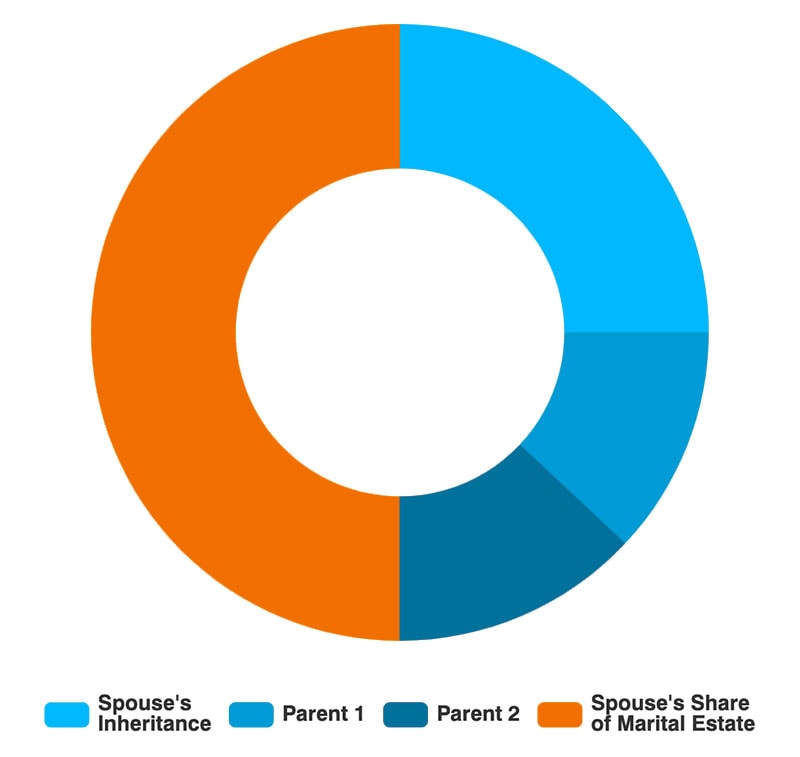

Rank 2 Scenario

Rank 2 Scenario (% of Total Assets Allocated per Successor)

- No surviving children so parents become successors.

- Surviving spouse is entitled to 50% of the value of the Marital Estate.

- The deceased’s portion of the Marital Estate (the remaining 50%) is shared as per the rules of rank 2 (half for the spouse and the rest equally between the parents).

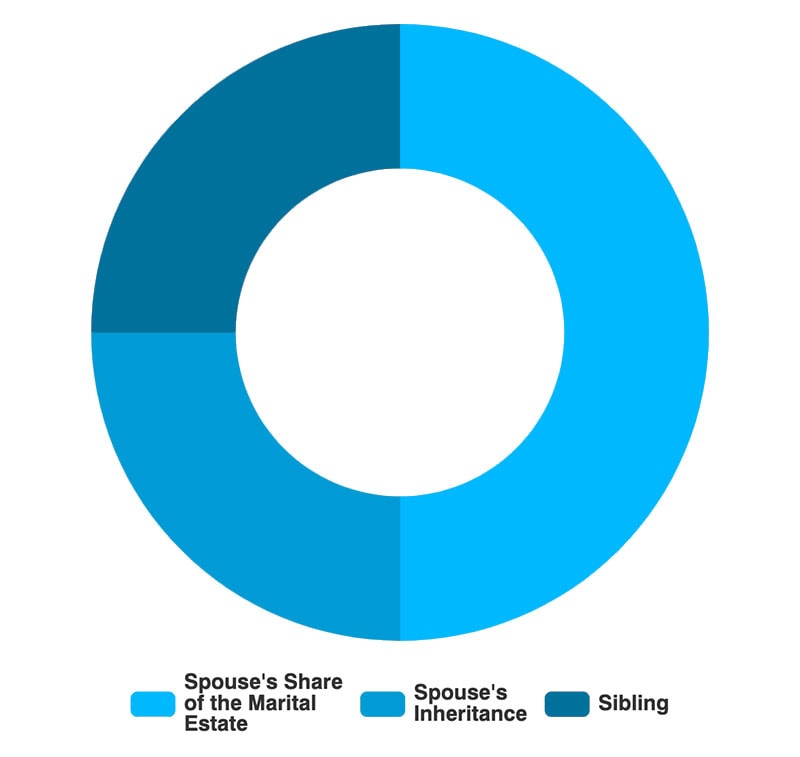

Rank 3 Scenario

Rank 3 Scenario (% of Total Assets Allocated per Successor)

- Surviving Spouse and Sibling.

- No Surviving Children or Parents.

- Surviving spouse is entitled to 50% of the value of the Marital Estate.

- The deceased’s portion of the Marital Estate (the remaining 50%) is shared as per the rules of rank 3 (half for the spouse and the rest equally between siblings).

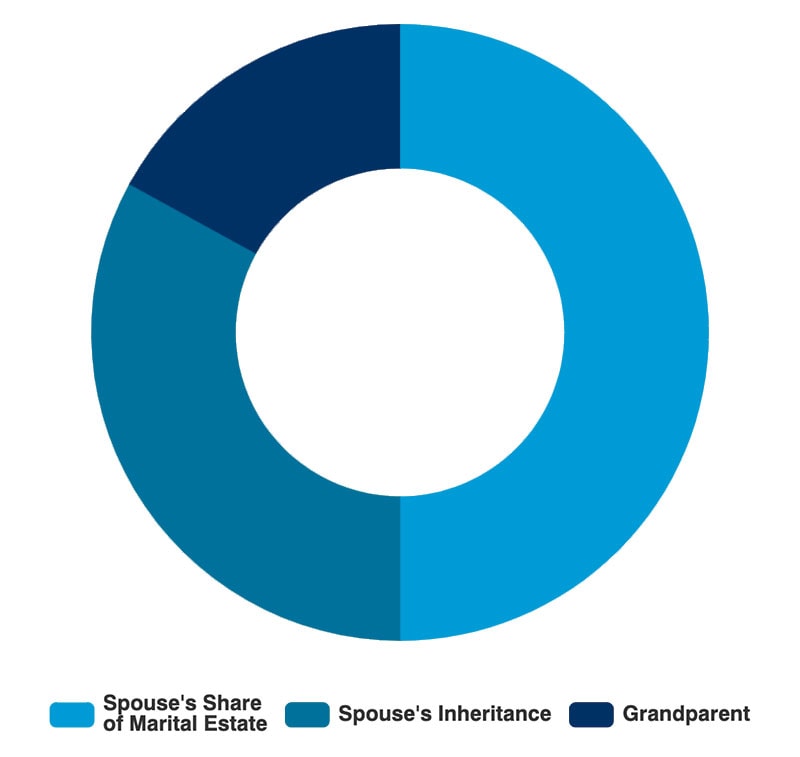

Rank 4 Scenario

Rank 4 Scenario (% of Total Assets Allocated per Successor)

- Surviving spouse and 1 grandparent.

- No surviving children, parents or siblings.

- Surviving spouse is entitled to 50% of the value of the Marital Estate.

- The deceased’s portion of the Marital Estate (the remaining 50%) is shared as per the rules of rank 4 (2/3 for the spouse and the rest equally between grandparents).

5. Taiwan Will Formalities

- 5 Types of wills in Taiwan:

- Holograph

- Notarized

- Sealed

- Dictated

- Oral

- A will made in the U.S. and notarized by a U.S. notary public will not be valid in Taiwan.

- If a will to be used in Taiwan is made in the U.S., it must be notarized by a Taiwan notary at the Taiwan Economic and Cultural Representative Office (TECRO).

5.1 Types of Wills

Holograph Will

- Handwritten by Testator.

- Must state the year, month and day of drafting.

- Must be signed by Testator.

- In case of any insertion, cancellation, erasure or alteration, Testator must make and sign an additional note stating the place in the text where words have been inserted, erased or altered, and the number of such words.

Notarized Will

- Testator makes an oral statement of his/her testamentary wishes before a public notary and at least 2 witnesses.

- The statement must be written down, read over and explained by the public notary, and, after the testator has given approval, signed by the Testator together with the witnesses and the public notary.

- Must state the year, month and day of drafting.

- If the testator is not able to sign his name, the public notary must state the circumstances and make him affix a fingerprint in lieu of a signature.

- The functions of the public notary may be exercised by a court clerk or by a Taiwan consul overseas.

Sealed Will

- Testator must preferably handwrite the will, however, it is possible to have a different person type or handwrite the will.

- Testator must sign the will and have it securely enveloped and signed across the seam of the envelope.

- Testator must then do the following in front of at least two witnesses and a public notary:

- Declare that this is the Testator’s will.

- Declare the name and domicile of the person that drafted the will, if it was not the Testator him/herself.

- Ask the public notary to state on the envelope.

- The date on which the will is brought.

- The declarations made by the Testator.

- Ask the public notary and the witnesses to sign the envelope.

- The functions of the public notary may be exercised by a court clerk or by a Taiwan overseas.

Dictated Will

- Testator must make an oral statement of his/her testamentary wishes in front of at least 3 witnesses.

- The Testators wishes may then be written down by one of the witnesses.

- The will must indicate the year, month and day of signing, and the name of the person who drafted the will.

- The Testator’s wishes must then be read over and explained by one of the witnesses.

- After the Testator has given approval, the statement must be signed by all the witnesses and the Testator.

- If the testator is not able to sign, an affixed fingerprint may be used in lieu of a signature.

Oral Will (Only valid in case of “imminent danger of death or other exceptional circumstances ”)

- In front of at least 2 witnesses, the Testator states orally testamentary wishes, name, the year, month and day.

- All the witnesses must make an oral statement as to the genuineness of such will and state their names.

- All statements by the Testator and the witnesses must be recorded in audio or video form. The recording must be securely enveloped immediately, and all the witnesses must sign their names across the seam of the envelope.

- The oral will becomes invalid after 3 months if Testator is able to make a different type of will.

- An oral will must be presented by successors within 3 months of Testator’s passing.

- A Taiwan court may rule on the validity of an oral will if disputes arise.

5.2 Witnesses

The following persons may not act as witness of a will:

- A minor

- A person who is subject to an order of commencement of guardianship or assistantship.

- An heir/successor, his/her spouse or his/her lineal relatives by blood.

- A legatee, his/her spouse or his/her lineal relatives by blood.

- Persons who are assistants to, or employed by, or living together with, the public notary or the person that exercises the functions of a public notary.

5.3 Limitations to Asset Distribution

A will for use in Taiwan may not contravene any of the below conditions specified in Articles 1187 and 1223 of the Civil Code.

- For a lineal descendant by blood, the compulsory portion is one half of his entitled portion.

- For a parent, the compulsory portion is one half of his entitled portion.

- For a spouse, the compulsory portion is one half of his entitled portion.

- For a brother or a sister, the compulsory portion is one-third of his or her entitled portion.

- For a grandparent, the compulsory portion is one-third of his entitled portion.

“Entitled Portion” refers to the portion the successor would have received if the deceased did not have a will.

From a practical point of view, relatives cannot be disowned, and their allocated portion of the estate cannot be less than half or one-third of their Entitled Portion, depending on the relation.

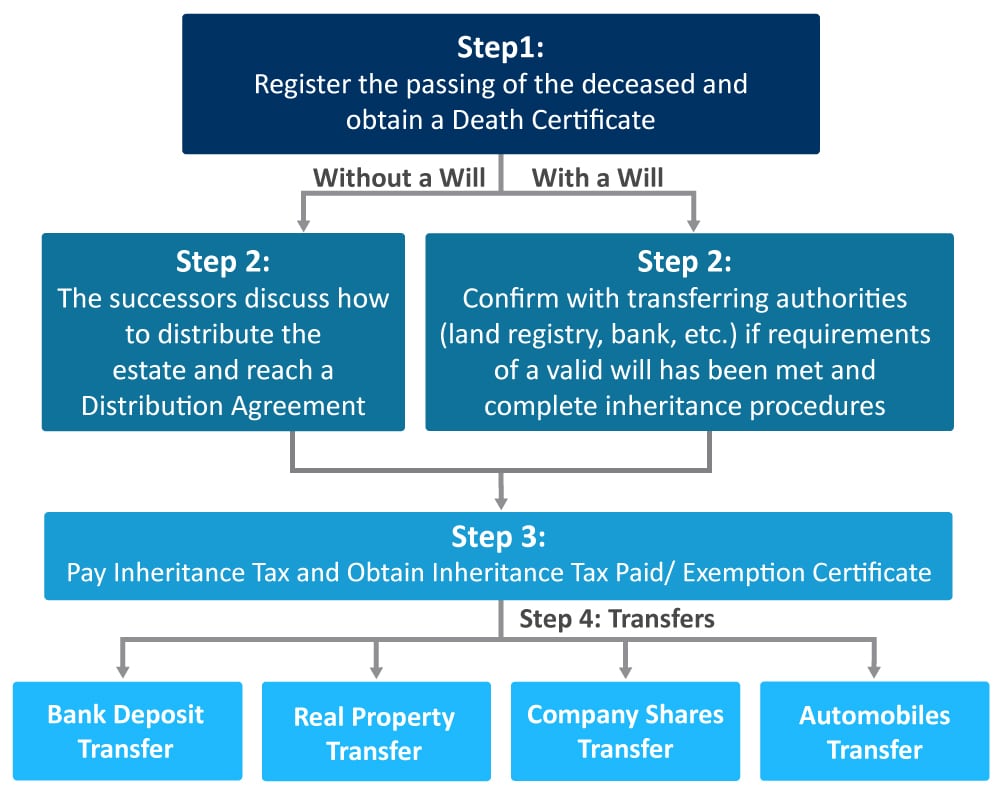

6. Overview of Inheritance System in Taiwan

6.1 Process

If the successors do not have a full list of assets of the Deceased, Pamir can liaise with the tax office to search for all assets in the deceased’s name.

6.2 Required Documents

- Power of Attorney*—Authorizing a Person in Taiwan to Act on Behalf of the Successors to Pay Inheritance Tax and Register Change of Ownership of the Assets.

- Passports and Identification Documents of Successors.

- Passports and Identification Documents of Deceased (Taiwan and any other country).

- Birth Certificate, Marriage Certificate or Other Documents Showing Relation to Deceased.*

- Death Certificate*

- Will* (if any)

- Distribution Agreement* (if any)—If any successors heirs waive their proportion of the inheritance assets or reallocate distributions.

* If the document is issued outside of Taiwan, it must be notarized by a local notary and legalized by the Taiwan Economic and Cultural Representative Office (TECRO) with jurisdiction over that location.

Documents Needed to Obtain Inheritance Certificate (Documents Specific to Assets Being Inherited):

- Original Land Deeds

- Original Building Deeds

- Bank Passbook Listing the Deposits in the Deceased’s Account(s)

- Original Share Certificates

- Title Documentation to Automobiles to be Inherited

If the successors do not have a full list of the assets of the deceased, Pamir can liaise with the local tax office to obtain a list of assets in their records.

6.3 Use of Trusts in Taiwan

- While Taiwanese law recognizes Trusts, they are cumbersome, costly and do not allow a Beneficiary to be a Trustee. Therefore, the use of trusts in Taiwan as an estate planning tool is very rare.

- Title to Real Estate, Stock and Other Assets are Typically held in the name of an individual or company.

7. Inheritance/Gift Taxes in Taiwan

Different portions of the inheritance/gift are taxed at different rates:

| INHERITANCE TAX | GIFT TAX |

|---|---|

| Portion between NTD 0 and NTD12,000,000: EXEMPT | Portion between NTD 0 and 2,200,000: EXEMPT |

| Portion between NTD12,000,000 and NTD50,000,000: 10% | Portion between NTD 2,200,000 and 25,000,000: 10% |

| Portion between NTD50,000,000 and NTD100,000,000: 15% | Portion between NTD 25,000,000 and 50,000,000: 15% |

| Portion above NTD 100,000,000 : 20% | Portion above NTD50,000,000: 20% |

Taiwan’s Inheritance Tax Applies to Assets Worldwide.

Sample Inheritance Tax Calculations

| NTD 6M Inheritance | NTD 60M Inheritance | NTD 200M Inheritance | |

|---|---|---|---|

| Portion between NTD 0 and NTD12M | 0 | 0 | 0 |

| Portion between NTD12M and NTD50M | 0 | NTD38,000,000 x 10% = NTD 3,800,000 | NTD38,000,000 x 10% = NTD 3,800,000 |

| Portion between NTD50M and NTD100M | 0 | NTD10,000,000 x 15% = NTD 1,500,000 | NTD50,000 x 15% = NTD7,500,000 |

| Portion above NTD 100M | 0 | 0 | NTD100,000 x 20% = NTD20,000,000 |

| Total Tax Due | 0 | NTD5,300,000 | NTD31,300,000 |

8. Common Estate Planning Issues for Taiwan

- Use of a U.S. (Overseas) Will

- Assets in Taiwan Cannot be Held by a U.S. (Overseas) Trust

- Proving Identity of Heirs/Successors

- Gathering Documentation

- Obtaining Notarizations and Legalizations (Dealing with Consular Bureaucracy)

Pamir’s Estate Planning Service